Form I-9 serves as a tool for employers to confirm that they are employing individuals who have the legal authorization to work in the United States.

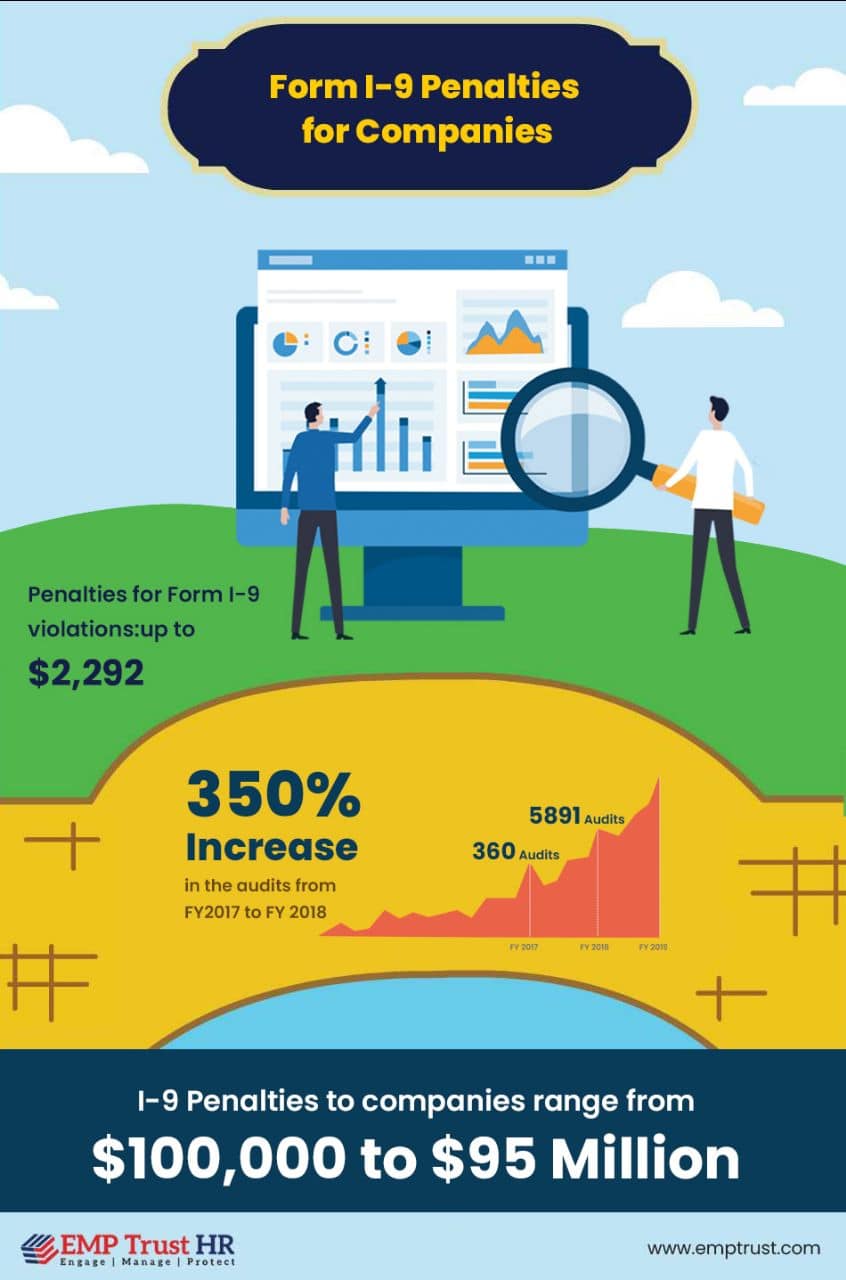

- U.S. Immigration and Customs Enforcement (ICE) can impose penalties for errors or omissions on Form I-9.

- The penalty amounts have seen a recent increase and vary based on factors such as the size of the company and the number of violations.

- As of 2022, for first-time paperwork violations relating to I-9, fines range between $252 and $2,507 per each substantive violation or uncorrected technical error.

- Subsequent paperwork violations can attract fines between $1,161 and $2,322.

- If an employer knowingly hires unauthorized non-citizens, penalties for first offenses range from $627 to $5016 for each worker.

- Second and subsequent offenses in this category can attract fines from $5,016 to $25,076.

- Employers who attempt to deceive ICE or disregard credible warnings could face severe fines.

- ‘Subsequent offenses’ penalties can be imposed regardless of when the previous punishment occurred.

- Both the frequency of inspections and the amount of fines have increased significantly in recent years. For example, in Fiscal Year 2019, ICE issued 6500 Notices of Inspections and collected $14.3 million in fines, penalties, and forfeitures.

Source: Paycor