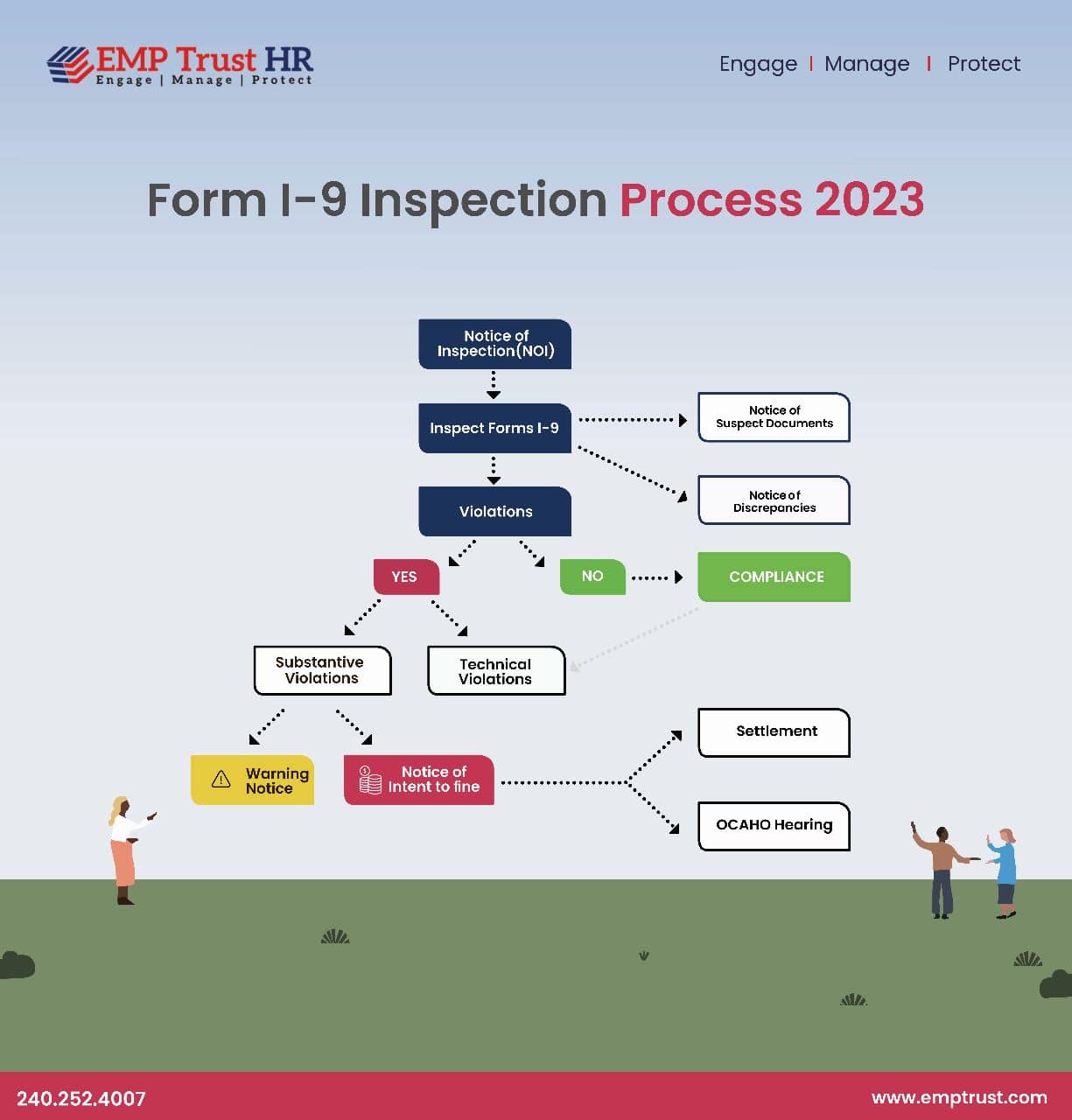

Steps involved in the Form I-9 inspection process:

- Initiation: Notice of Inspection (NOI) is served to employers, compelling the production of Forms I-9.

- Deadline: Employers are given at least three business days to produce I-9 forms and supporting documentation (e.g., payroll, employee list, Articles of Incorporation, business licenses).

- Inspection: ICE agents/auditors assess Forms I-9 for compliance.

- Corrections: Employers are granted ten business days to rectify technical/procedural violations under INA §274A(b)(6)(B) (8 U.S.C. § 1324a(b)(6)(B)).

- Penalties: Fines are imposed for substantive and uncorrected technical violations.

- Cease Unlawful Activity: Employers knowingly hiring unauthorized workers must stop the activity, may face fines, and could be criminally prosecuted.

- Debarment: Employers hiring unauthorized workers risk are debarred by ICE from future federal contracts and government benefits.

- Monetary Penalties: Fines range from $375 to $16,000 per violation for knowingly hiring unauthorized workers; $110 to $1,100 per violation for failing to produce a Form I-9.

- Penalty Factors: ICE considers business size, good faith effort, violation severity, involvement of unauthorized workers, and history of previous violations when determining penalties.